Yen Rebounds as Ueda Hints at Policy Shift

- BoJ stands pat as expected, lowers core CPI projection

- But yen rebounds on Ueda’s relatively hawkish remarks

- Risk sentiment improves on China’s stimulus plan

- S&P 500 and Dow Jones hit fresh record highs

BoJ’s Ueda brings yen to life

The yen was the protagonist on Tuesday, coming under some selling interest after the BoJ kept its ultra-loose policy unchanged as expected and lowered its forecasts for core inflation for the fiscal year beginning in April to 2.4% from 2.8% projected in October.

Nonetheless, at the press conference following the decision, Governor Ueda said that they expect the Japanese economy to pick up moving forward and that the likelihood of achieving their inflation 2% objective is gradually rising. He also added that they’ve heard encouraging comments from big firms on wage hikes, and that a policy change is possible even when there is no update to the quarterly outlook, even though they will have more data to work with in April than March.

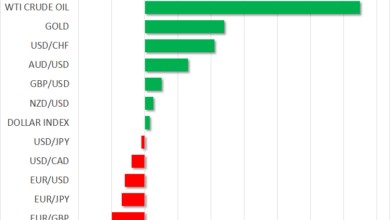

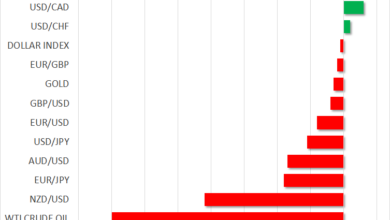

Ueda’s comments allowed the yen to stage a solid comeback, and take the driver’s seat among the major currencies, as investors brought forth their expectations regarding a potential interest rate hike. They are now nearly fully factoring in a hike from -0.1% to 0% in June, while ahead of Ueda’s presser, a 10bps hike was factored in for July. They are even assigning a 23% chance to the March decision.

As for the much-discussed April meeting, the first after the ‘shunto’ wage negotiations, the probability for a hike has gone from below 50% to slightly above 60%, which means that there is ample room for upside adjustment should upcoming data and speeches by BoJ officials corroborate that view. This could help the yen extend today’s recovery.

Dollar slides, stocks gain on China headlines

The US dollar was sold across the board today, perhaps on increasing risk appetite after news hit the wires that China is considering a 1trln yuan worth of fiscal stimulus and a similar sized bond stimulus in order to heal its wounded stock market.

Chinese stocks rose after the report, while the aussie and the kiwi rebounded, which suggests that investors are cheering the stimulus plan. However, global money managers, who have been selling Chinese stocks after the post-pandemic recovery faded, said that it will take a long time and more stimulus to repair the property sector, which accounts for nearly a quarter of China’s GDP. This means that today’s news may not be enough to turn the tide for Chinese equities.

Wall Street extends rally, gold rebounds

All three of Wall Street’s main indices extended their gains, with the Dow Jones and the S&P 500 hitting fresh record highs as high-growth tech firms continued to shine ahead of upcoming corporate earnings releases.

Netflix (NASDAQ:NFLX) is reporting results today after the closing bell, while tomorrow it will be Tesla’s turn. Apart from earnings announcements, on Thursday, Wall Street investors will also have to digest the first estimate of the US GDP data for Q4, ahead of next week’s FOMC decision.

Gold rebounded today, perhaps benefiting from the dollar’s slide. That said, with investors notably reducing their bets regarding a March Fed rate cut, it may be hard for today’s rebound to evolve into something bigger if Thursday’s GDP data and next week’s gathering prompt participants to further push back their rate cut expectations.

In the energy world, oil prices gained yesterday on supply concerns after a Ukrainian drone hit Russia’s Novatek fuel terminal, forcing it to suspend some operations, at a time when extreme cold weather in the US continues to hold back crude production.