OPEC+ Meeting in Focus: Will Oil Production Cuts Continue Through March 2025?

- Oil prices are currently stable, but OPEC+ is likely to extend oil output cuts into Q1 2025 due to weaker global demand.

- China’s oil demand may have peaked due to a decline in transport fuel demand and the rise of electric vehicles.

- Upcoming API and EIA oil inventory data releases will provide insights into US crude supply levels and influence oil prices.

Oil prices are holding steady near the $72.35 support level, staying in a 6-day period of little movement. OPEC+ meets on Thursday, and there’s a higher chance they will extend their oil output cuts to Q1 2025.

OPEC + to Consider Oil Cut Rollover

OPEC+, which produces about half of the world’s oil, has been planning to slowly increase production until 2025. But weaker global demand and more oil being produced outside the group have created challenges and pushed prices down.

One source told Reuters that the group will likely extend output cuts into the first quarter, though all sources chose to stay anonymous.

Oil prices have remained pressurized for large parts of this year with support arriving as a result of geopolitical concerns rather than demand optimism.

OPEC+ is limiting oil production by 5.86 million barrels a day, which is about 5.7% of global demand, as part of steps agreed on since 2022 to keep the market stable. They had planned a small increase of 180,000 barrels a day in January, but this plan has been delayed because oil prices have dropped.

The question is how much longer will this go on given that the Oil demand outlook for 2025 does not look that appealing at present. With the US likely to increase output under a Trump Presidency, 2025 looks as if it will be an intriguing one.

Has Chinese Oil Demand Peaked?

According to an IEA China Researcher, Oil product demand excluding petrochemical feedstocks peaked in 2023. Crude imports are also projected to peak next year as concerns have grown this year largely on the back of poor performance by the real estate sector.

Another reason cited is that a decline in transport fuel demand may add to oil demand woes. There is concern that these developments could end the country’s decade-long run as the dominant driver of expanding oil consumption globally.

The growing adoption of EV vehicles in China has also accelerated the concerns and is likely to lead to demand plateauing next year. The rise in EV adoption has led to a situation where the petrochemical sector will be the main sector to underpin demand moving forward.

All in all consensus appears to be growing that Chinese crude imports have or will peak in the next year or so. Although Jet Fuel demand is expected to rise it is not enough to offset the declines in other areas.

Crude Oil Net Imports in MLN T (China)

Source: LSEG

Oil Inventory Data Ahead

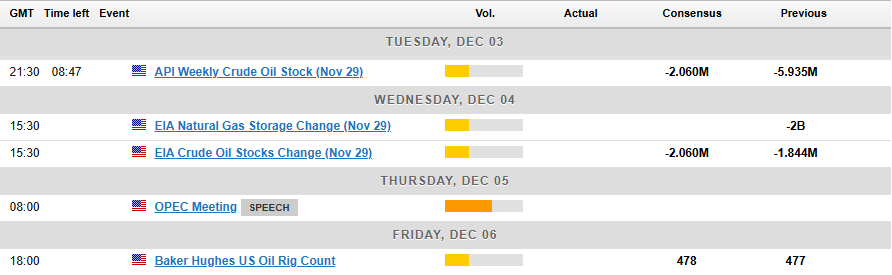

The upcoming API and EIA oil inventory data releases on December 3 and 4, will provide critical insights into US crude supply levels, helping traders and analysts gauge the balance between supply and demand.

If the data reveals a larger-than-expected inventory build, it may signal weaker demand or oversupply, likely putting downward pressure on oil prices. Conversely, a substantial draw in inventories could highlight tighter supply conditions and potentially trigger a price rally.

Either way the bigger question on my mind is whether either move will be sustainable.

Technical Analysis

From a technical perspective, Oil has been rangebound for the last six trading days as bulls try to push price toward the recent swing high at 75.00.

At the time of writing Oil is up around 1.44% on the day and this could in part be down to rumors around a 3 month extension by OPEC + to production cuts. However, this delay was largely expected and unless we get a daily candle close above the 73.00 handle there is still a possibility of intraday pullback.

This is just based on recent history with Crude prices testing the 73.00 handle over the last two trading days being met by significant bearish pressure. Will today prove to be different?

Immediate resistance rests around the 75.00 handle before the 76.35 resistance zone comes into focus where we also have the 100-day MA.

Alternatively, a push lower from current prices will have to navigate support around the 72.38 handle, before the 71.00 handle becomes an area of focus.

Brent Crude Oil Daily Chart, December 3, 2024

Source: TradingView

Support

- 72.38

- 71.00

- 70.00 (key area of confluence)

Resistance

- 75.00

- 76.35

- 76.83

Most Read: US Dollar Index Rise Amidst Trump’s BRICS Warning and French Uncertainty

Original Post